Historic Lawsuit: Anderson v. Pacific Gas and Electric Co.

DRB Capital Appoints Amanda Dobanton as Chief Compliance Officer and Promotion to General Counsel

March 18, 2024

How to Get Cash for Structured Settlement Payments

June 1, 2024The Hinkley Groundwater Contamination Case

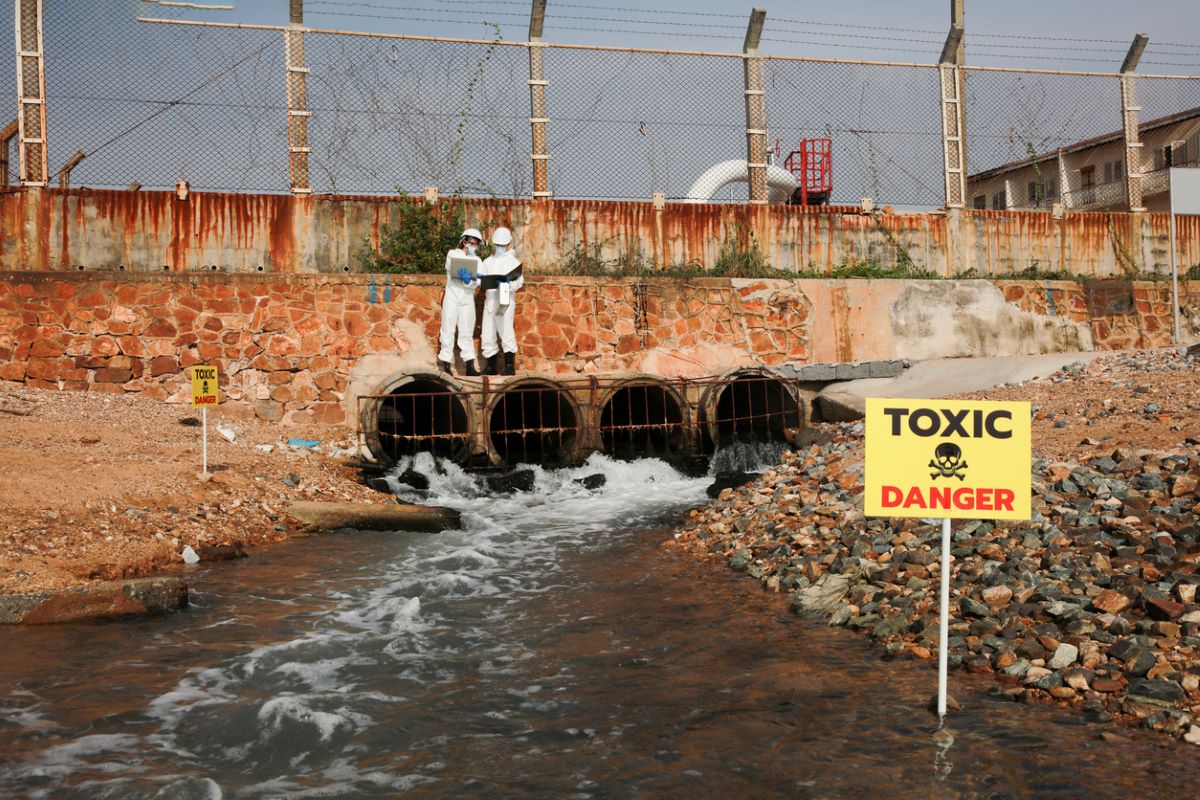

Anderson v. Pacific Gas and Electric Co. , also known as the Hinkley groundwater contamination case, is a landmark legal case that brought attention to the dangers of environmental pollution and corporate negligence. The case, which was filed in 1993, involved the residents of Hinkley, a small town in California, who claimed that Pacific Gas and Electric (PG&E) contaminated their groundwater with hexavalent chromium, a toxic chemical that is known to cause cancer.

, also known as the Hinkley groundwater contamination case, is a landmark legal case that brought attention to the dangers of environmental pollution and corporate negligence. The case, which was filed in 1993, involved the residents of Hinkley, a small town in California, who claimed that Pacific Gas and Electric (PG&E) contaminated their groundwater with hexavalent chromium, a toxic chemical that is known to cause cancer.

Are you receiving structured settlement payments as a result of a serious injury? If so, contact DRB Capital at 877-894-4541 for your free, no-obligation quote and learn more about how we purchase your future structured settlement payments for a lump sum of cash.

The Background of the Case

In the 1950s, PG&E began using hexavalent chromium at its natural gas compressor station in Hinkley to prevent rust in cooling towers. The company stored the chemical in unlined ponds and allowed it to seep into the groundwater. For over 30 years, PG&E knew about the contamination but did not disclose it to the residents of Hinkley.

In 1987, a utility worker named Erin Brockovich, who was working as a legal clerk at the time, discovered that Hinkley residents were suffering from various health problems, including cancer, due to the contamination. Brockovich brought this to the attention of her boss, Edward L. Masry, a lawyer in California. Masry and Brockovich filed a lawsuit against PG&E on behalf of more than 600 Hinkley residents who were affected by the contamination.

The Legal Battle

The trial began in 1993 and lasted for several months. The plaintiffs claimed that PG&E knew about the contamination for years but did not inform them or take steps to remediate the problem. The plaintiffs also claimed that PG&E tried to cover up the contamination by doctoring reports and lying to regulators. PG&E denied any wrongdoing and argued that the hexavalent chromium levels in the groundwater were not harmful. The company also claimed that the plaintiffs’ health problems were not caused by the contamination. PG&E presented its own experts who testified that the contamination was not a health risk.

In 1996, the jury awarded the plaintiffs $333 million in compensatory damages. This was one of the largest settlements in a direct action lawsuit in US history. The jury found that PG&E acted with malice and fraud, and the company was ordered to pay out these punitive damages.

The Impact of the Case

The Anderson v. Pacific Gas and Electric case was significant in many ways. It brought national attention to the issue of environmental pollution and corporate negligence. The Hinkley groundwater contamination case also highlighted the importance of environmental regulations and the need for companies to be held accountable for their actions. It also had a significant impact on the legal system. The verdict in Anderson v. Pacific Gas and Electric set a precedent for other cases involving environmental contamination and corporate misconduct. It also led to changes in California law that made it easier for plaintiffs to bring toxic tort lawsuits against corporations.

The Anderson v. Pacific Gas and Electric case was significant in many ways. It brought national attention to the issue of environmental pollution and corporate negligence. The Hinkley groundwater contamination case also highlighted the importance of environmental regulations and the need for companies to be held accountable for their actions. It also had a significant impact on the legal system. The verdict in Anderson v. Pacific Gas and Electric set a precedent for other cases involving environmental contamination and corporate misconduct. It also led to changes in California law that made it easier for plaintiffs to bring toxic tort lawsuits against corporations.

Furthermore, the case became the subject of a Hollywood movie titled “Erin Brockovich” in 2000. The movie, which starred Julia Roberts as Brockovich, brought even more attention to the case and the issue of environmental pollution.

Landmark Cases and Subsequent Personal Injury Lawsuits

Personal injury lawsuits are legal cases that are filed by individuals who have been injured due to the negligence or intentional actions of another party. These types of lawsuits can arise from a variety of situations, including car accidents, slip and falls, medical malpractice, and product liability. Personal injury lawsuits can result in compensation for damages such as medical expenses, lost wages, and pain and suffering.

Anderson v. Pacific Gas and Electric was a landmark case that brought attention to the dangers of environmental pollution and corporate negligence. The case showed that companies can be held accountable for their actions, and that victims of pollution have the right to seek compensation for their damages. The case also led to changes in California law and set a precedent for other cases involving environmental contamination. Today, the legacy of Anderson v. Pacific Gas and Electric lives on as a reminder of the importance of protecting the environment and holding corporations accountable for their actions.

Structured Settlements in Personal Injury Lawsuits

Structured settlements are a type of financial agreement that is frequently used to settle personal injury lawsuits. A structured settlement involves a series of payments made over time to the plaintiff, rather than a lump sum payment. Payments can be designed to meet certain needs, such as covering medical costs or providing ongoing income.

Structured settlements are a type of financial agreement that is frequently used to settle personal injury lawsuits. A structured settlement involves a series of payments made over time to the plaintiff, rather than a lump sum payment. Payments can be designed to meet certain needs, such as covering medical costs or providing ongoing income.

Benefits of Selling Structured Settlements

While structured settlements can provide financial security for plaintiffs, they may not always be the best option. In some cases, plaintiffs may need a larger sum of money upfront to cover immediate expenses, such as medical bills or living expenses. In these situations, selling structured settlement can provide a solution. Selling a payment stream involves transferring the right to receive future payments to a third-party company in order to receive a lump sum payment. This can provide plaintiffs with the cash they need to cover immediate expenses or invest in other opportunities.

Contact Us Today to Sell Your Structured Settlement Payments

If you or someone you know has been involved in a personal injury lawsuit and has been awarded a structured settlement, it’s vital to consider all options before accepting the settlement. If you are already receiving long-term payments, however, there are other options available to you. Selling structured settlements can provide fast financial relief and allow plaintiffs to take control of their financial future. Contact us today at 877-894-4541 to learn more about the benefits of selling structured settlements and to receive your no-obligation quote.

DRB Capital does not provide professional financial or legal advice and the Site is not intended as a substitute for professional financial or legal advice. Persons accessing this information assume full responsibility for the use of the information and understand and agree that DRB Capital is not responsible or liable for any claim, loss or damage arising from the use of the information. All content provided is for informational purposes only. DRB Capital makes no representations as to the accuracy, completeness, currentness, suitability, or validity of such content and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use.